LOSS MITIGATION SOLUTION FOR MORTGAGE SERVICERS

Expand mortgage servicing capacity without compromising consumer experience

Our end-to-end loss mitigation default management platform is a customizable and mobile-friendly solution. Homeowners and mortgage servicers can complete all necessary tasks - from upfront application and processing to final document execution - to speed processing and increase pull-through.

Self-service mortgage software designed to guide homeowners seeking mortgage assistance from anywhere and at any time

| HOMEOWNER ENGAGEMENT PORTAL

Stavvy’s Homeowner Engagement Portal is a mobile-friendly mortgage servicing solution that helps borrowers struggling with making their mortgage payments through a responsive and user-friendly digital loss mitigation application. Dynamic survey-like questions quickly direct consumers to the proper loss mitigation options to get their mortgage back on track.

Digital mortgage servicer communication and portal messaging keep homeowners informed and engaged at every phase of the loss mitigation process until the application is closed. Homeowners can automatically link income and asset information in addition to uploading necessary documentation.

Increase default management scope while decreasing marginal variable labor costs through automated default management workflows

| SERVICER DEFAULT MANAGEMENT PORTAL

The business operations of every mortgage servicer are unique. That’s why Stavvy offers a customizable mortgage servicing software solution that enhances loss mitigation efficiency and compliance while allowing mortgage servicers to define a system that meets their specific workflow parameters.

The Servicer Default Management Portal lets users assign tasks to teams or specialized individuals with workflow customization tools. Stavvy's proprietary Rules Engine further supports mortgage servicing teams by providing real-time decisions against investor/insurer guidelines and compliance requirements based on homeowner-provided data. All while remaining flexible in times of regulatory change, resulting in no compliance-related downtime.

Not all homeowners are willing or able to go digital. Stavvy’s Servicer Default Management Portal lets users bring paper and phone applications online for teams to process digitally. These actions, and all others within the platform, are digitally logged into a fully automated timeline, bringing full visibility to mortgage servicing operations.

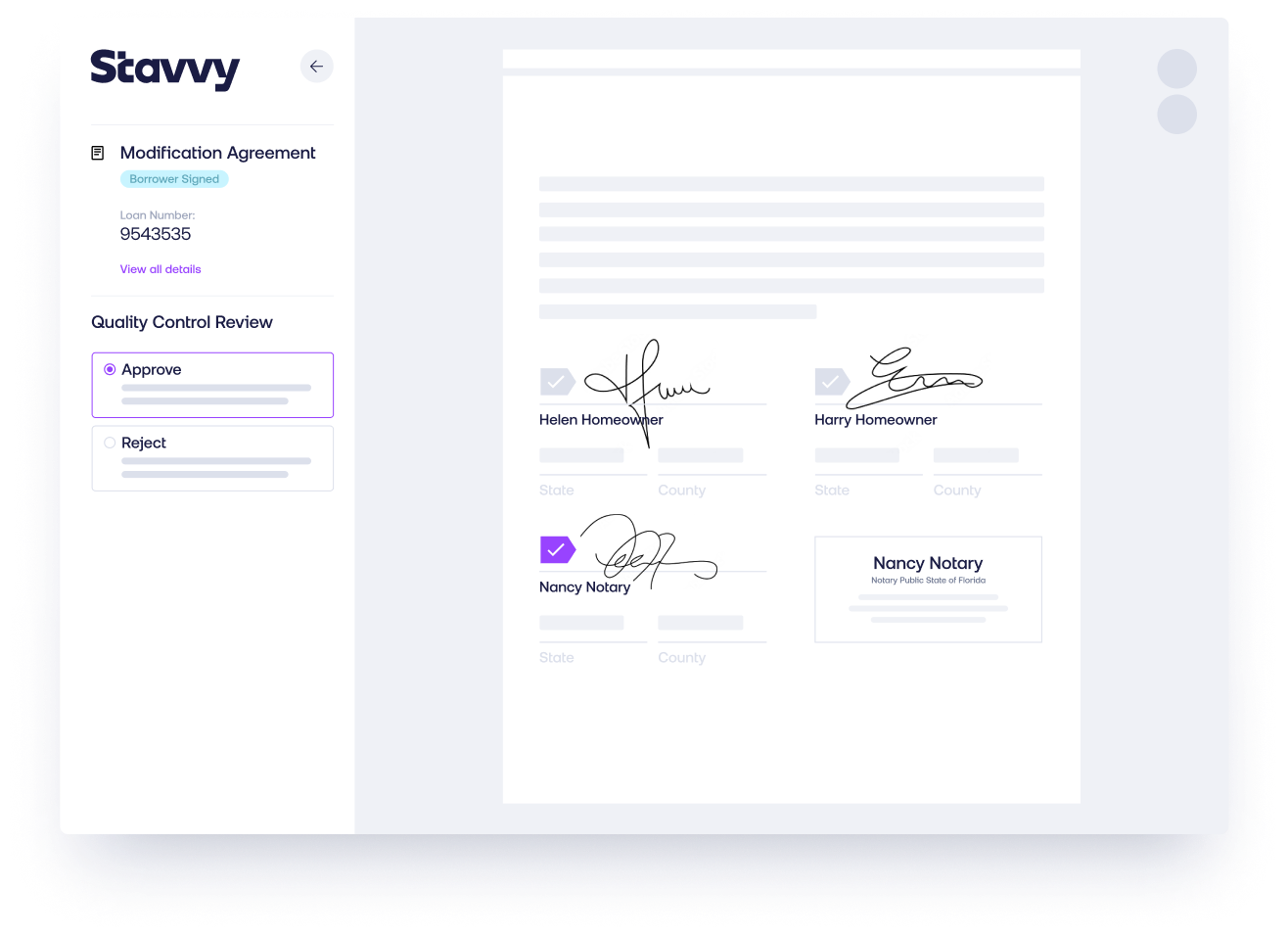

Finalize default management documents remotely and electronically

| DIGITAL EXECUTION AND NOTARIZATION HUB

The Digital Execution and Notarization Hub connects Stavvy’s RON, IPEN, and eSign capabilities with all digital mortgage servicing-related documentation. This culminating feature makes Stavvy a true end-to-end loss mitigation default management solution.

The Digital Execution and Notarization Hub allows mortgage servicers to reduce or even eliminate much of the paper associated with this process. This digital mortgage signing solution offers quick execution for consumers and lender countersigning, eliminating the unnecessary step of tracking down loan modification agreements or partial claims - meaning no more delays due to needing to re-sign because of lost mail or paperwork.

Finally, the addition of a digital signing process not only speeds up execution time but also adds an extra layer of security. Digital identity verification, fully detailed transaction audit details, video recordings, and tamper-evident documents are all enhancements to traditional mortgage servicing protocols.

Flexible Notary Options

| NOTARY SIGNING SERVICE

Stavvy’s Digital Execution and Notarization Hub allows mortgage servicers to use their in-house notaries or leverage a team of skilled notary professionals. Seamlessly integrated into the Stavvy platform, our trusted network of real estate notaries expertly tag documents and oversee digital execution, facilitating a seamless experience for you and your homeowners.